One Person Company Registration

What it means?

One person company (OPC) means a company formed with only one (single) person as a member, unlike the traditional manner of having at least two members. It is a form of a company where the compliance requirements are lesser than a private company.

Service Price options:

Beginner

From ₹11,490

From ₹4,500

Standard

From ₹12,590

From ₹5,500

All inclusive

From ₹13,590

From ₹6,500

Preliminary Documents Checklist

Driving License/ Passport/ Voter ID

Electricity Bill, Municipal Tax Receipt, Rent Agreement or Lease Agreement

Process Brief

Key Benefits

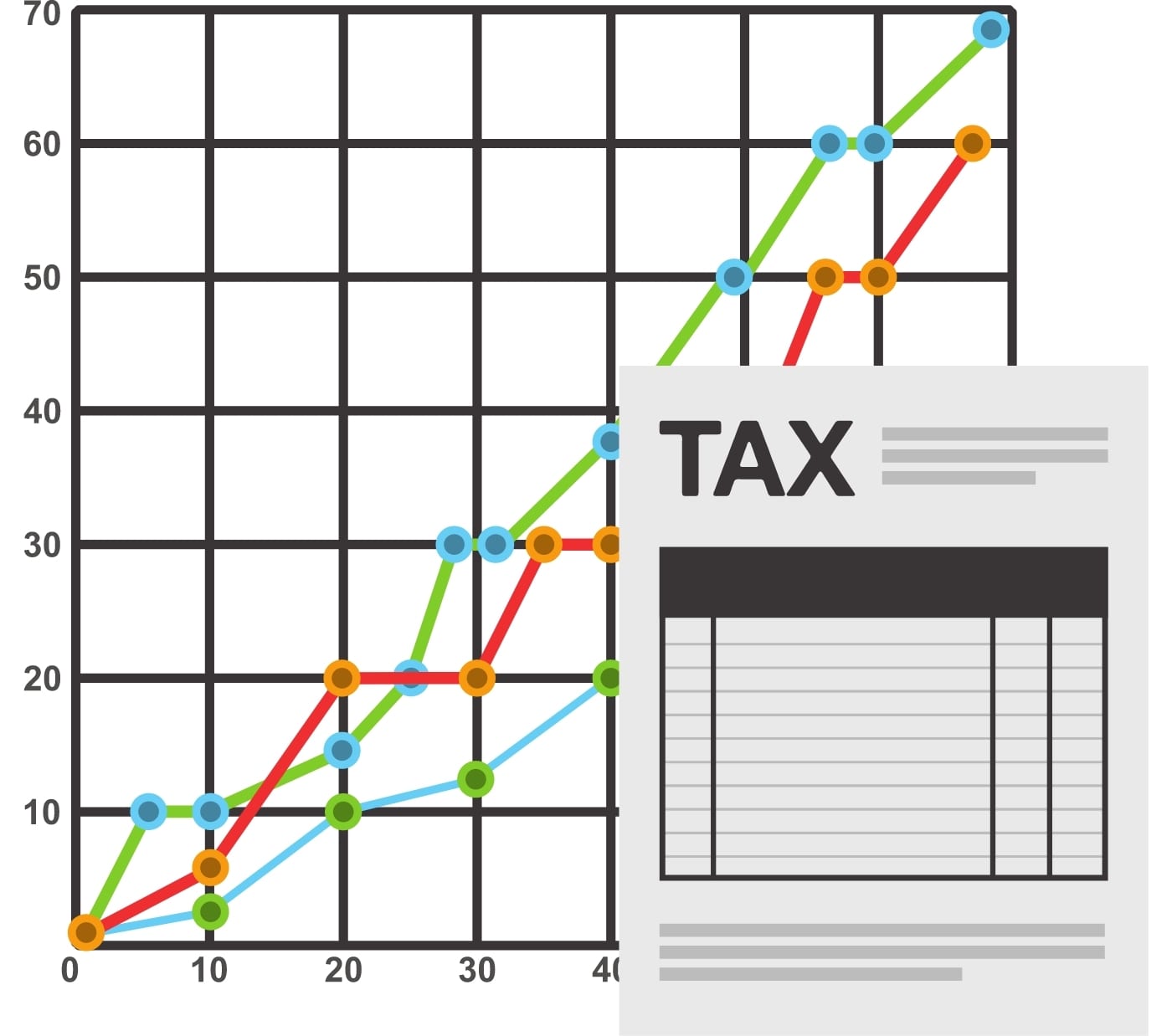

Compliances of One Person Company

GST Returns

Monthly, Quarterly & Annual GST Returns are required to be filed for those who have opted for GST Registration and who crosses required thresholds.

Bookkeeping & Accounting

Bookkeeping records are required to be prepare in order calculate the exact profit and loss of the business. However not mandatory, but beneficial.

Income Tax Returns & Audit

Income tax returns needs to filed every year over taxable income. This may also require preparing Profit & Loss with Balance sheet & getting tax audit for business.

OPC are required to do annual filings with Register of Companies (ROC) & need to get Audited and follow regular compliance.

Statutory & MAT Audit

Irrespective of its sales turnover or nature of business or capital, all OPC must have its book of accounts audited each financial year. along with MAT audit.

Didn't answer your question?

Don’t worry!! Our expert will help you to choose the best suitable plan for you. Get in touch with our team to get all your queries resolved. Call us @+91 9870114333

Indian citizen who are adult residents can start an OPC. As an Individual you cannot start more than one OPC, but you can be a part of other businesses. A minor however, can be neither member nor nominee in an OPC.

It is person nominated by the sole promoter of the OPC (One Person Company) who in the event of death of disability of the promoter shall assume his/her position. It is mandatorily prescribed in MOA of OPC.

In case the paid up share capital of an OPC exceeds 50 lakh rupees or its average annual turnover of immediately preceding three consecutive financial years exceeds two crore rupees, then the OPC has to mandatorily convert itself into a private or public company.

DIN, Director Identification Number, is a unique 8 digit number required by any person proposed to be a Director in the Company.

Digital signature or DSC is equivalent to physical certification but it is relevant electronically. It is needed by concerned department in various forms which required to comply with digital signature.

MOA stands for Memorandum of Association whereas AOA means Articles of Association. While incorporation a company such as Pvt. Ltd, both of these act as essential source of information for various shareholders & other stakeholders.

MOA reveals the name, aims, objectives, registered office address, clause regarding limited liability, minimum paid up capital and share capital of the Company.

AOAs are the necessary documents to be submitted when the company is incorporated with the Registrar of Companies (ROC).

To ensure that we’re the right company for your services required even before you spend a single rupee, and to make working with us as easy as possible, we offer free quotes for your requirements. The form on the other side allows you to request a free quote from us for your specific requirements, no matter how big or small it is.

Other Services we offer :

- Sole Proprietorship Registration

- Partnership Firm Registration

- Limited Liability Partnership Registration

- Private Limited Company Registration

- NGO/Section 8 Company Registration

- GST Registration

- MSME Registration

- Shop & Establishment Act License & Registration

- GST Returns Filings

- Income Tax Return Filing

- TDS Return Filing

- Company ROC Annual Filings & Compliance

- FSSAI Licensee & Registration

- Import & Export Code (IEC) Registration

- Digital signature (Class 3)

- Professional Tax Registration

- Bookkeeping & Accounting

- Net worth Certificate

- Trademark Registration