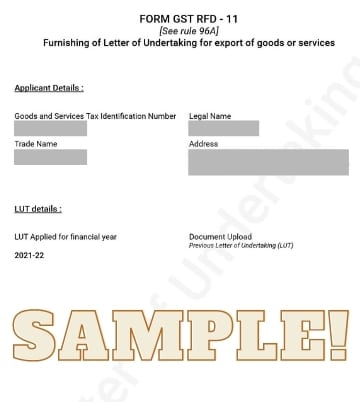

Letter of Undertaking (LUT) under GST

What it means?

All registered taxpayers who perform exports of Goods or Services and who wish to make their exports without the payment IGST, will have to furnish Letter of Undertaking (LUT) in GST.

At Tax Unbound, We offer unbeatable prices and best customer service. Kindly select your preferred pricing option below and request us a quote.

Service Price options:

Standard

From ₹2,500

✅ Filing of One Letter of Undertaking with GST

✅ LUT Consultation

✅ Application tracking

✅ Processing Time: 24-48 hours

All inclusive

From ₹5,000

From ₹4,500

✅ Filing of One Letter of Undertaking with GST

✅ Import Export Code (IEC) Registration (Additional Govt. Fee of Rs 500 will be applicable)

✅ LUT & IEC Consultation

✅ Application tracking

✅ Processing Time: 24-48 hours

Satisfied Customers

Tax Unbound is ONE STOP solution !

Tax Unbound is ONE STOP solution for all the Taxation and financial need with great and professional staff. Never seen such a highly professional CA firm ever. I recommend everyone to avail their service. Once again thank you Tax Unbound and Team helping me.

Super Quick and Reliable Service

Thanks to Team TaxUnbound for their super quick service for our first-time firm registration. It was really smooth and great experience.

Must Try!

Best experience in first time. I did not know about anything about GST and all that other stuff for my business but their support team help me like family. Team is hard working, experienced and knowledgeable. They will support you at every stage of the process.

Preliminary Documents Checklist

Required for singatory & of 2 more wintesses.

(e.g. GST certificate, trade license etc.)

Such as electricity bill, property tax receipt (in case of own) and if rented, then rental agreement)

(Cancelled check copy or Bank certificate). If you don't have a cancelled check available, then we will provide a proforma for the bank certificate.

Process Brief

Key Benefits for LUT

Didn't answer your question?

Don’t worry!! Our expert will help you to choose the best suitable plan for you. Get in touch with our team to get all your queries resolved. Call us @+91 9870114333

No. LUT is valid for the complete Financial Year only and have to be renewed next year.

IF LUT is not filed, all of your exports will be considered as domestic sales and respective IGST will be applied and have to paid.

Its is usually recommended to that the witnesses should not be part of your close family circle. It can be anyone outside that.

Yes we provide services PAN India.

To ensure that we’re the right company for your services required even before you spend a single rupee, and to make working with us as easy as possible, we offer free quotes for your requirements. The form on the other side allows you to request a free quote from us for your specific requirements, no matter how big or small it is.

Other Services we offer :

- Partnership Firm Registration

- One Person Company Registration

- Limited Liability Partnership Registration

- Private Limited Company Registration

- NGO/Section 8 Company Registration

- GST Registration

- MSME Registration

- Shop & Establishment Act License & Registration

- GST Returns Filings

- Income Tax Return Filing

- TDS Return Filing

- Company ROC Annual Filings & Compliance

- FSSAI Licensee & Registration

- Import & Export Code (IEC) Registration

- Digital signature (Class 3)

- Professional Tax Registration

- Bookkeeping & Accounting

- Net worth Certificate

- Trademark Registration